Many entrepreneurs begin fleshing out the details of a new service or product with personal funds, taking on debt in hopes of paying it back with future profits. As dreams grow more significant, seeking funding has typically included traditional Venture Capitalists (VC), private equities, and revenue-based financing.

Technology startups at the forefront of innovation use token-based blockchain marketplaces to fund new businesses as they forgo traditional VC funding.

Companies like Tezos, raising over $230 million and status.im $100M in under 3 hours, have proven the success of funding innovative ideas in a fraction of the time with ICOs.

How ICO Funding Works

Any company in any stage of development can begin selling tokens or coins at any time.

Cryptocurrency coins can be purchased in exchange for benefits ranging from equity to physical services and can be sold and traded in a blockchain marketplace. Early on, these digital currency tokens can be purchased by the public and by investors at a discounted rate and, ideally, appreciate as the company grows and meets targets.

The big differentiator is the shift in who can invest in new business.

Traditionally, VCs have access to new ideas and decide the best ventures to invest in. The growth of Initial Coin Offering (ICO) opens the doors for the public to freely invest, which has led to an increase in funds available to and opportunities for early-stage startups.

ICOs Open Doors

Initial Coin Offerings (ICO) make it possible for ventures in the earliest stages to source necessary funding and grow a community before the product release.

How is that possible?

ICO is a crowdsourced fundraising method that takes advantage of a virtual coin sold to investors to raise capital for a new startup. Entrepreneurs now have the opportunity to trade real money for these virtual tokens that can be saved, traded, and/or used for services offered by the startup.

ICO token

- Equity. Equity tokens work like shares and offer investors the opportunity to vote on company initiatives.

- Asset. Asset tokens make it possible to trade items not currently available on the blockchain market, like shares in a rental property.

- Utility. Utility tokens act as company currency and can only be used for goods and services from the company they’re sold by and any partnering organizations.

A startup can choose to offer any of the three forms of ICO or some combination thereof, giving investors the benefit of quick return while building an army of actively invested customers and brand advocates.

Raising: VC or ICO?

According to a recent Goldman Sachs report, as of August 2017, more capital is being raised by ICOs than from traditional, early-stage venture capital.

Source: CNBC

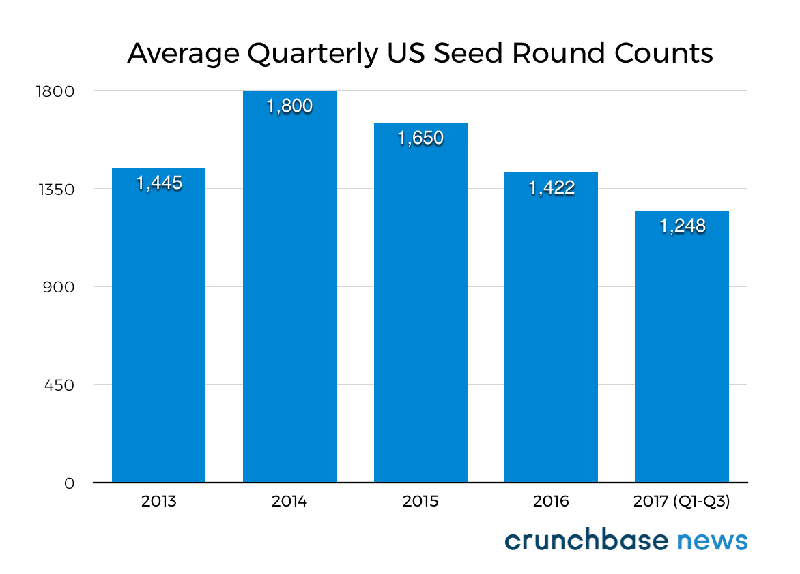

Quarterly seed round counts have been on the decline since 2014 due to VCs pulling back on investments into early-stage startups and instead focusing their spending on more promising, later-stage ventures. Green entrepreneurs aren’t backing down. Seed-stage startups in the tech space are increasingly looking to ICOs and other crowdsourced funding methods to jumpstart their big ideas, a strategy that’s helped spur recent ICO activity.

The Benefits of ICOs

Early Stage Startups Have A Golden Ticket

«VCs are used to being the gatekeepers of capital. There’s this old narrative of entrepreneurs going hat in hand begging VCs for money. That absolutely is not the world we’re in anymore,» says Olaf Carlson-Wee, founder of hedge fund Polychain Capital.

ICOs have made it possible for startups to raise funds in the early stages without stepping foot into a VC office or giving a single presentation. Entrepreneurs merely need a whitepaper detailing what’s to come to entice the public to invest.

VCs generally focus their attention and investments in startups with a team and proven results, offering their expertise and connections in exchange for equity. But now that early-stage startups have ICO’s options, funding can be raised long before VCs show any real interest.

Startup Investment For All

With more startups turning to ICOs for early-stage funding, opportunities for the average person to invest and support an entrepreneurial revolution are greater than ever.

ICO relies on online crowdfunding to raise capital and can be sought by any startup at any stage, widening the pool of potential investors. In building such a large group of investors, startups are fueled by a community that believes in the company’s mission and is personally invested in promoting the growth and success of all it does.

Venture capitalist Taizo Son believes “[ICOs are] very good because they democratize venture financing for not only professionals like venture capitalists, but also individuals can participate in exciting projects from startups to support.”

Coins can be offered to traditional VCs and advisors at lower prices in exchange for their sage advice and support.

Removing VC Constraints Opens Up Opportunity

Funding secured from VCs and angel investors is almost always exchanged for a percentage of equity and decision-making power. Finding the right balance between the funding a startup needs and the number of equity founders are willing to relinquish in the early days is tricky. If founders give up too much equity, they could lose voting rights and power over their own company, but without the proper funds, startups may not hire a reliable team and bring their products to market.

ICOs make it possible to raise as much as ten times the funds of what a venture round might result without giving away any equity or control. This flexibility allows entrepreneurs to create and iterate without oversight and offer equity later when they know more clearly what skills and support they need in an advisor.

The blockchain marketplace is built for the opportunity, making it possible to verify millions of transactions without expensive brokers or exchanges. Technology-focused startups are building cryptocurrency-like ledgers as platforms for selling these tokens or coins, the currency sold in ICO.

Golem Factory GmbH is behind one of these blockchain-based platforms. Using their secure platform, coins can be bought and sold in exchange for access to computing power. Last November, Golem raised $8.6 million in ICO, offering tokens to be exchanged as currency for fast and reliable computing power.

Higher Payoff Potential

Supporting an ICO can be risky since most companies in this stage have very little to show as proof of their future potential. In contributing to an ICO, public investors assume a great amount of risk, in hopes of an even greater reward.

When a company is successful, ICO token value increases to meet investors’ demand, eager to get a piece of the pie. Unlike buying shares in an IPO, ICO bets are made much earlier in a company’s inception, usually before or during early development. While the risk is high, the potential for gain is even greater.

And while big payoffs are the goal of many public investors in ICO, the potential to develop new technologies and apply them across a variety of industries is astronomical. Companies offering ICO are working to develop Earth-shattering tools that will likely impact entire markets from healthcare to government. An investment in ICO can be equated to an investment in our future.

ICOs On the Rise

With seemingly endless opportunities and low entry barriers, ICOs are just gaining ground and continue to grow daily. In 2016 a total of 46 ICOs raised a combined $96.3 million, and as of November, 228 ICOs have already raised $3.6 billion in the capital for 2017. That’s more than a 5x increase in ICO investments in less than a year!

ICOs Managing Risk

Of course, no great reward is ever gained without some amount of risk, and raising startup funds with an ICO is no exception.

VCs prefer to invest in late-stage startups because they already have established teams and proven results. Early-stage startups, on the other hand, might not have either, making it difficult for investors to see a return worth investing in. Investors are left far too vulnerable if a startup isn’t profitable and ICO tokens devalue. While many may be eager to invest before or during the ICO stage, most won’t return again if burned by an unsuccessful venture.

As blockchain platforms grow, the shape of the cryptocurrency market is taking form, yet remains decentralized and largely unregulated. The risk of hacking and theft was made all-too-real for startup CoinDash, which lost $7 million in an overnight attack that changed the ethereum destination address.

The United States Securities and Exchange Commission (SEC) is working to monitor and investigate digital assets sold by virtual organizations, particularly ICOs.

«We seek to foster innovative and beneficial ways to raise capital, while ensuring – first and foremost – that investors and our markets are protected. Investors need the essential facts behind any investment opportunity so they can make fully informed decisions, and today’s Report confirms that sponsors of offerings conducted through the use of distributed ledger or blockchain technology must comply with the securities laws,» said William Hinman, Director of the Division of Corporation Finance.

ICOs won’t replace VC

While ICOs have proved to be one of the quickest ways for early-stage startups to raise funds, they’re not meant to entirely replace the value of VC and angel advisors.

Startups have great power in passionate ambition, quick iteration, and their ability to pivot on a dime, but they often lack the wisdom, experience, and network connections that can be gained in partnering with a trusted investor. Entrepreneurs who realize this commonly offer discounted tokens to VCs prior to making an ICO public and VCs enjoy the benefit of a quicker return than common in early-stage startup equity investments.

The role of the venture capitalist has shifted, allowing investors to either buy digital tokens directly in ICOs or invest in hedge funds that purchase tokens in the offering. Although early investors are encouraged to stick around to see the startup through to a big payout, contracts may allow an early exit in ventures that grow in a different direction than a VC recommendation.

Of course, ICOs aren’t are a good fit for every startup. Tech startups that don’t have anything to do with blockchain technology will continue to seek funding directly from VCs and angels.

“It’s a very exciting time to be an investor and entrepreneur in the cryptocurrency and blockchain space. Investors should now be preparing themselves for a new wave of unicorns that will be built on top of blockchain technologies,” advises Bernard Moon of SparkLabs Group.

ICOs and VCs are both here to stay, actively leading the advancement of technology, culture and information. Welcome to the golden age of entrepreneurship and investing!