AI Product Developer

The Battle for Dominance Begins – Which One Will Prevail?

As the financial services landscape evolves in the new digital economy, various tech leaders are eager to tap into this niche and secure a share of the profits. Apple has recently announced a high-yield savings account, offering an attractive 4.15% APY, which is likely to draw new users and take clients from its competitors. However, with the increasing acceptance of cryptocurrency, Apple’s foray into this domain poses a threat to crypto’s dominance.

In this article, we explore the battle for dominance between Apple Card’s high-yield savings account and cryptocurrency yields, comparing their user-friendliness and stability as investment options. The evolving financial landscape raises questions about the future of centralized fintech companies like Apple and decentralized cryptocurrencies. Ultimately, innovation and adaptability will be crucial factors in determining the victor in this clash of financial titans.

Apple’s Bold Move: A High-Yield Savings Account

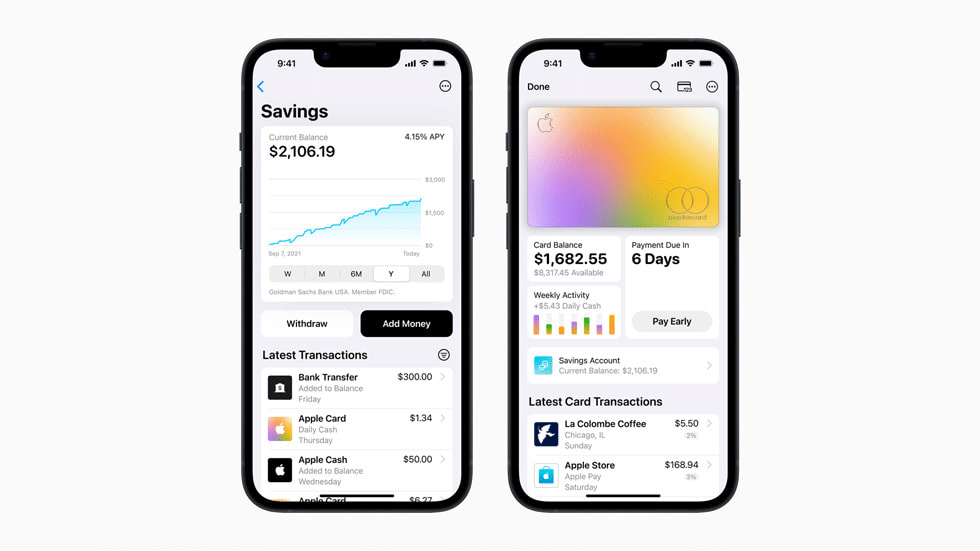

Apple Card users can now open a Savings account with Goldman Sachs to boost their Daily Cash rewards. The account offers a high-yield 4.15% APY, no fees, and easy management through the Apple Card in the Wallet app. This user-friendly savings feature emphasizes financial wellbeing and security. According to Apple’s announcement, the user’s Daily Cash earnings will be automatically transferred into the account. The destination for Daily Cash can be modified whenever desired, and there is no cap on the amount of Daily Cash one can accumulate. To enhance their savings, users have the option to deposit extra funds into the Savings account via a connected bank account or from their Apple Cash balance. Will all of these features Apple’s foray into the financial sector could be a game-changer for the industry.

Cryptocurrency Yields: The Waning Power of Stablecoins?

On the other hand, users might wonder whether investing in Apple’s new yield savings account is more advantageous than venturing into cryptocurrencies, as news stories often report individuals making thousands of dollars daily. When considering crypto investments, the safest approach to grow one’s savings is through stablecoins. In simple terms, stablecoins are cryptocurrency assets pegged to real-world assets, such as the US dollar, which continues to dominate the financial market.

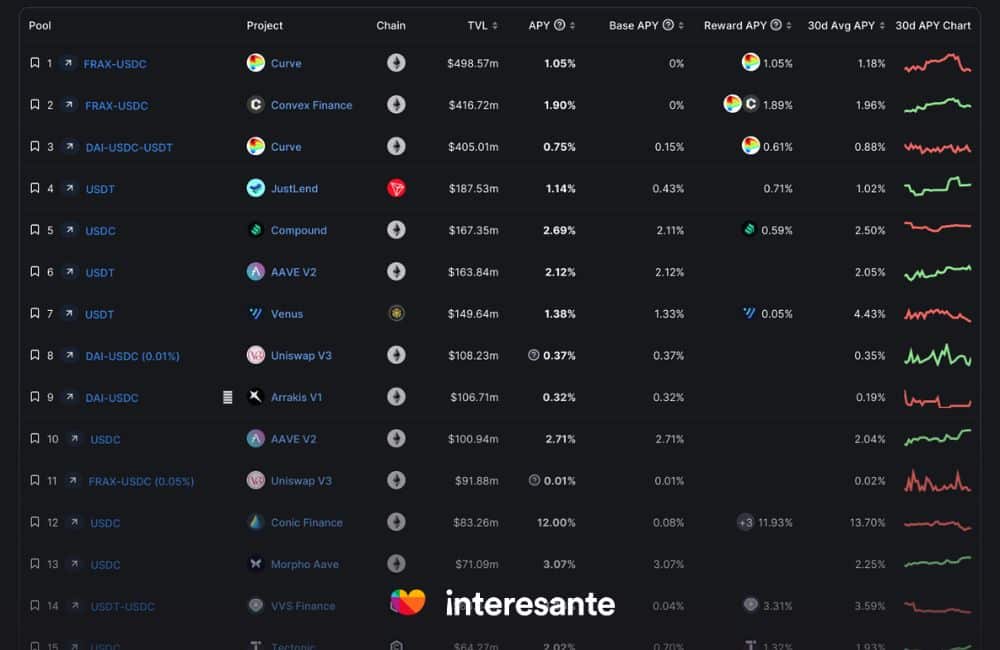

Investors can deposit their «digital dollars» in various pools across different platforms using decentralized finance, a new financial instrument accessible in the crypto world. Although yields from these platforms were once highly attractive in a bull market, they have decreased significantly in recent times. Investing in crypto carries inherent risks, which is why many users opt for Ethereum as their platform of choice, as it is the most secure blockchain for decentralized finance in the crypto market.

However, crypto yields on stablecoins have diminished, with Ethereum-based stablecoins providing a maximum of 2.60% APY, users may find Apple’s service more enticing. Users usually prioritize stable and reliable services that offer minimal risk, even though some cryptocurrencies might offer high yields. This is why a comparison has been made between the yields of Ethereum and Apple, since Ethereum is the safest blockchain.

The Future of Financial Services: Centralized Fintech vs. Decentralized Crypto

As Apple’s new card feature may not necessarily take away crypto users, it highlights the need for developers and token economics designers to create new ways to attract and retain users in the crypto world. With centralized fintech companies offering similar products, the crypto industry must focus on making its services more user-friendly to compete effectively.

The financial services landscape is evolving, and the future is uncertain. Will centralized fintech companies like Apple eventually dominate the industry, or will decentralized cryptocurrencies continue to grow in popularity? The answer may lie in how well each sector can adapt to changing consumer preferences and integrate emerging technologies.

A Race to Innovate

Ultimately, the battle between Apple’s high-yield savings account and crypto yields is a testament to the rapidly changing financial landscape. Both centralized fintech companies and decentralized cryptocurrencies have their unique advantages and will need to innovate continuously to stay ahead of the competition.

As consumers, we can benefit from this competition by having more choices and better financial products at our disposal. The future of financial services is bound to be exciting as these two giants vie for dominance. Who will emerge victorious remains to be seen, but one thing is for sure: the race is on.