AI Product Developer

The Central American country famously known for being a tax haven, Panama, has approved a bill regulating specific cryptocurrencies. Even though cryptocurrencies would not be legal tender in the country, citizens could still transact with them as any other currency. The missing step to support the bill is the president’s signature.

No Votes against the Adoption of Cryptocurrency in Panama

Panama’s national assembly lawmakers approved a bill to regulate cryptocurrencies and tokenized precious metals and other goods. In great joy, the country’s deputies announced that the assembly had approved the cryptocurrency bill on Twitter.

Aprobada la Ley de Crypto de Panamá! Esto ayudará a que Panamá se vaya consolidando como hub de innovación y tecnología de America Latina!

— Gabriel Silva (@gabrielsilva8_7) April 28, 2022

Crypto Law approved in third debate! This will help Panama become a hub of innovation and technology in Latin America!

There were 38 votes in favor, two abstentions, and no votes against during the voting period. It is pretty remarkable since this is a sign that lawmakers worldwide are changing their minds when it comes to digital assets. They are the economy’s future, and Panama realizes this by approving a law regulating cryptocurrencies.

The law considers eight cryptocurrencies, including Bitcoin, Ethereum, XRP, Litecoin, XDC Network, Elrond, Stellar, IOTA, and Algorand. The law will help the unbanked since 70% of the population has access to the internet while only 46% have a bank account.

Cryptocurrency Regulation Bill Overview

The bill does not allow cryptocurrencies to become legal tender but makes it possible to use them as a transaction medium. Before the bill, it was illegal to transact using digital assets. The law will treat crypto assets as a foreign source of income, which means no capital taxes. It not will not only regulate cryptocurrencies but will also allow the tokenization of precious metals and other goods.

Following El Salvador and Central African Republic Footsteps

Even though it will not make cryptocurrencies legal tender, the law’s approval will follow similar footsteps of El Salvador and the Central African Republic. In this regard, Panama will launch an official wallet similar to El Salvador’s Chivo wallet. It will allow citizens to transact with the different legal cryptocurrencies proposed by the bill.

The main difference between this new bill and El Salvador’s law is that it will not force the citizens to use crypto assets, and everyone can use them as savings, investments, or means of payment. According to Panama’s blockchain consultant, Moises Galé, the chosen cryptocurrencies were selected as a combination of first, second, and third-generation technologies that provide utility to the current financial system.

Panama’s new bill will also allow the government to migrate public records to the blockchain. It will help turn Panama into a digital hub in Latin America, attracting investments from institutional companies worldwide. Panama’s government will not only be allowed to use the blockchain to store public records but create its digital asset as well as the previously discussed digital wallet.

Finally, the bill discussed interoperability with Panama banks. It means that there will exist cooperation between traditional banking and the new digital assets introduced in the country. One of the bill’s main goals is innovating and moving forward in digital assets to evolve the economy and technology. For example, only 7% of the country has invested in crypto, and only 50% understand blockchain technology, so the bill includes a detailed plan for cryptocurrency education.

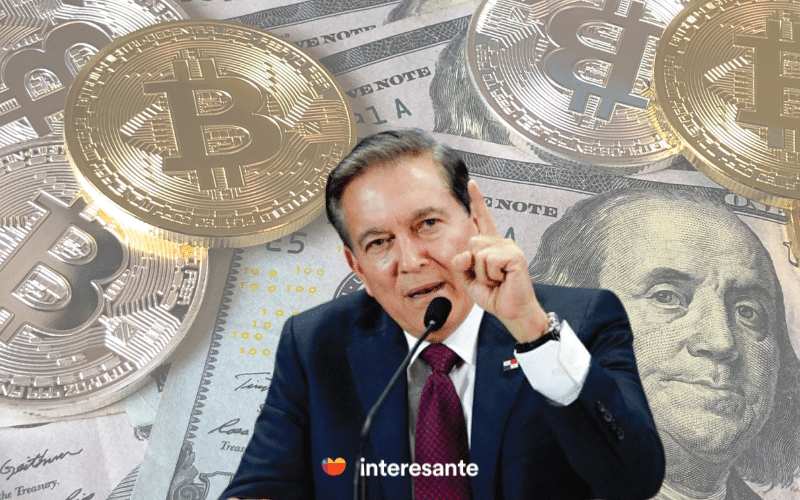

President Cortizo Needs Compliance With AML before Approving the Bill

Laurentino Cortizo spoke about his concerns regarding the cryptocurrency bill pushed forward by the nation’s legislative assembly. The president of the Central American country said that he would sign the law if it considered new clauses regarding AML (Anti Money Laundry). According to Cortizo, AML laws are essential for the country.

Even though the bill will not be approved immediately, Cortizo spoke about the benefits of cryptocurrency and how it can improve the country. The bill could be approved if some parts of the law are modified while others are entirely vetoed. The nation’s legislative assembly has to alter the bill to comply with Cortizo’s concerns.

Panama’s New Digital Asset Bill will Turn the Country into a Financial Hub

Even though Panama could partially veto the bill, the Latin American country will turn into a financial hub, setting an example for the rest of the world. Panama is already a prosperous country, and it will grow even more significantly with the regulation of digital assets. As we are experiencing the fourth industrial revolution and a paradigm shift in finance, every country will have to adapt to the new changes, and Panama is one of the first countries to take the first steps.

Implementing these new technologies in the country will benefit the citizens since Panama’s bill will bank the unbanked with the help of blockchain technology. Indeed, this is not an easy goal, but Panama’s bill will educate its citizens, allowing them to create new business and new ways to transact in the country. It will be the beginning of a new era in Latin America, and it is astounding that Panama is following in El Salvador’s footsteps.