Editor-in-Chief @ Interesante

The cap table is key to maintaining a clear and detailed record of startup ownership. To understand cap tables and their role within a startup from inception to exit, read the details we’ve put together for you in this post.

For informative cap table readings, we suggest you reference Brad Feld’s introductory post on cap tables and Gust’s on how to value your technology startup.

What is a Cap Table?

Fred Wilson, a New York-based VC, writes that a cap table stores all significant stockholders of the company and option holders. Similarly, Investopedia says that a capitalization table, also known as a cap table, is a spreadsheet or table that shows the equity capitalization. Cap Tables include stock, warrants, common equity shares, options, and other investment ownerships.

The cap table becomes more complex as the company grows and includes new funding sources, mergers, and acquisitions.

A capitalization table is most commonly utilized for startups and early-stage businesses, but all companies may use it. Many entrepreneurs are not very familiar with this term. It is essential to know and understand it since it is a crucial tool to see the impact of the financing received on the ownership of the Startup’s shares. This affects both aspects of control (decision making) and economics (possible exits).

Why is a cap table important for raising capital and hiring a team?

Using a well-managed capitalization table is important because it helps you explain why an employee is getting X number of options or shares within the context of equity. Let’s delve into how it works in the startup lifecycle.

How Does a Cap Table Work?

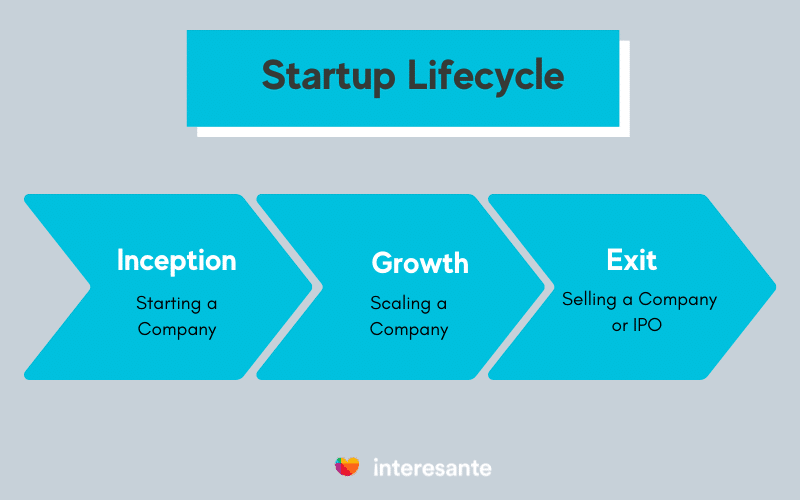

To understand the role cap tables have in a startup lifecycle, let’s assume that you’ve identified three phases of your lifecycle:

Tracking Startup Ownership with Cap Tables

Let’s assume that you and your founders created a fantastic company. There’s traction now, and the work you put in is finally paying off. So who gets what?

How is economic ownership distributed?

When starting a company, it is pretty standard for founders to perform a fixed, even split of equity in their company early on in the process. This is also similar to how founders set up team member option plans. However, as time progresses, the economic ownership of a company becomes more dynamic and fluid. This is common and a direct result of the shifting roles and responsibilities within the company and the number of stakeholders involved.

What is your company’s valuation?

Reiterating Fred Wilson’s post on equity ownership, you must understand your company’s valuation. This is the price point at which you would sell your business. A valuation can take the form of your recent exit offer, or it can be a public market analysis.

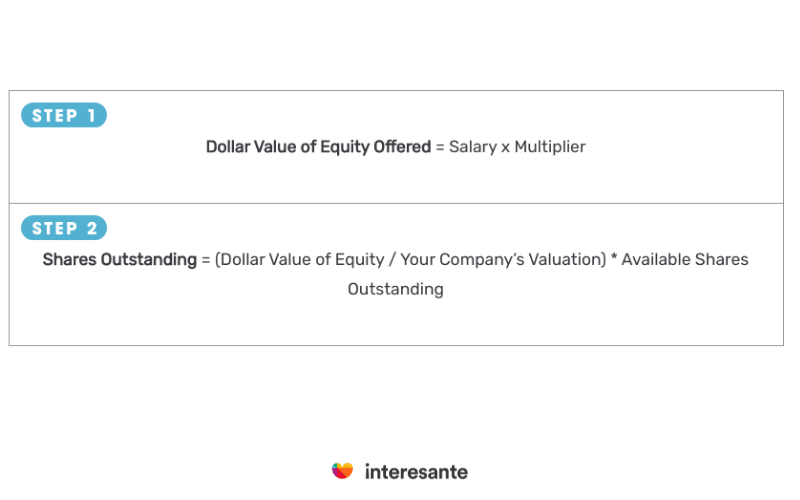

Secondly, understand how you are segmenting yourself and your employees. How many levels are there? Senior Level? Director Level? Junior Level? Finally, how much weight do you want to place in said roles?

Once you determine your company’s valuation, org structure, and the multiplier for each role (a subjective number based on how much weight/substance you and your founder place in each role), plug them into the following formulas:

Example: Cap Table for Company X

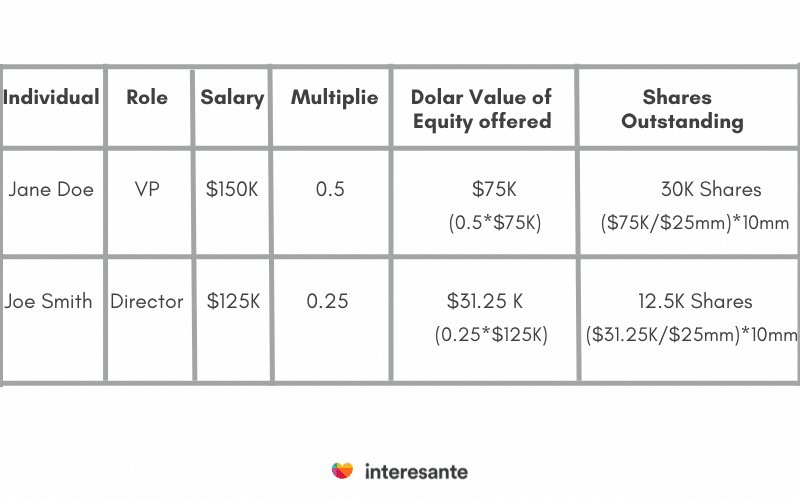

Below is an example of this formula in action, applied to your fictitious company and the positions you’ve identified within:

Your Company Valuation: USD 25M

Available Shares Outstanding: 10M

Employee Organization:

Handling funding and dilution with a cap table

After economic ownership by role has been identified, gears shift, and you can now focus on raising capital for your company. Understanding equity dilution is an important and complex concept. As time progresses, it is important to understand ownership over your own company will become more fluid than fixed over time.

What is dilution regarding equity?

Dilution is the decrease in the current economic ownership of a company due to new equity issuance. «In a more general way, dilution is the loss of value of existing shares due [to] new equity terms.» This typically happens when a startup looks for funding to grow a company. Sometimes, this means adding a new co-founder to the roster and/or hiring new employees.

Watch out for this common mistake.

A common misnomer many new startups believe is that their pre-money valuation determines their percentage ownership of the company. This isn’t the case. Dilution needs to be factored in to see what you own.

How does the Cap Table Look Like for Company X?

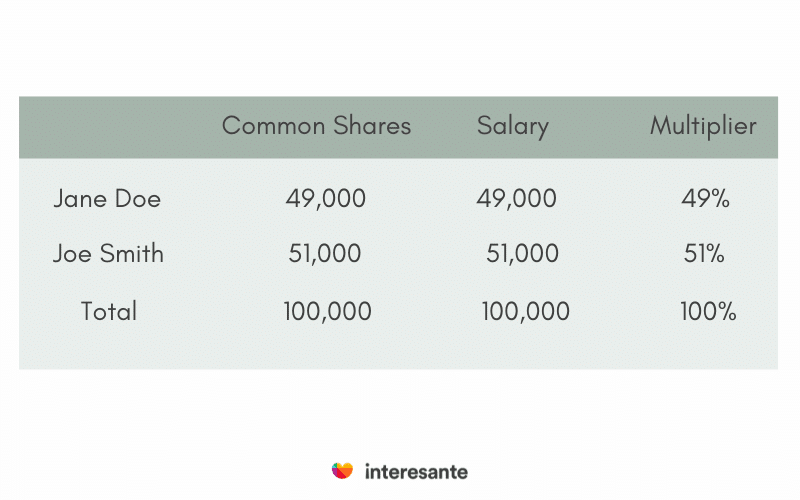

Let’s say a company’s initial cap table looks like this:

What are common shares?

You’ll notice that your cap table has a column for common shares. This column refers to securities representing part ownership of your company. Since they usually carry voting rights, company founders generally hold ordinary shares.

They reference the table above; founders Jane Doe and Joe Smith each own approximately 50% of the company. As a group, they own 100%. As the company grows, Jane Doe and John Smith are now looking to raise new capital.

In exchange for funding, there is commonly the issuance of new equity. The amount of dilution is subsequently dictated by the per-share price of the amount the company raises.

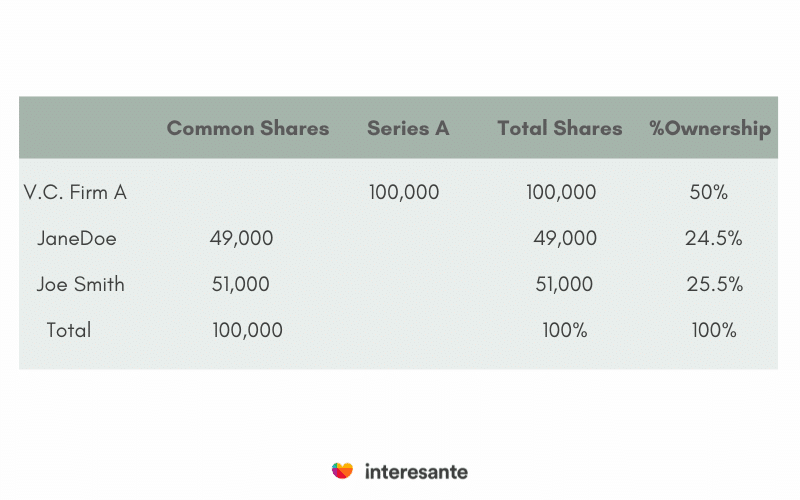

Here is what the cap table looks like when the company raises $1,000,000 at $10 / share from VC Firm A:

As you can see, the founders now collectively own only about 50% of the company. The founders’ ownership stake decreased, but now they also have $1,000,000 to grow the business.

According to Josh Maher, an angel investor, «a clean cap table and solid equity compensation can be worth more than the million-dollar investment alone.»

Think about cap table scenarios

You’ll likely include variations in your cap table that show what happens in various scenarios, such as if more shares are issued. In running scenarios, you’ll want to include transparent valuation calculations and percentages of ownership both pre-money, post-money, and fully diluted post-money. Before committing to an investment, investors will want to see exactly what they will own in all possible scenarios.

The Cap Table and your Exit Strategy

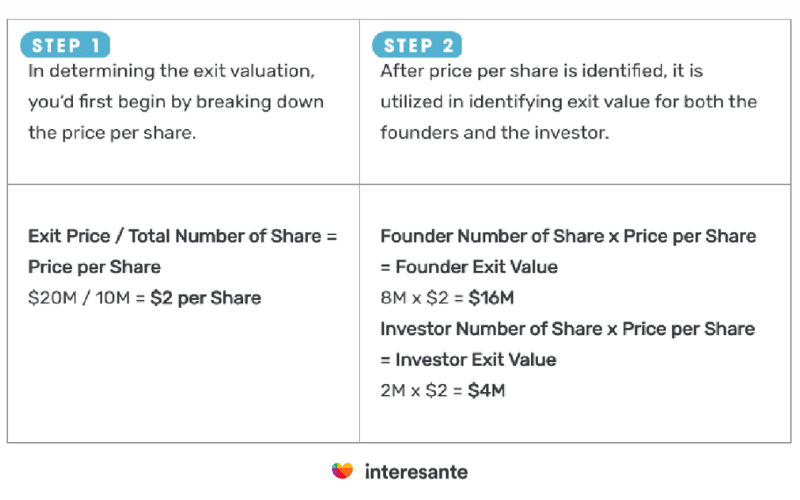

Congratulations! Your company is now thriving, and there is mutual interest between you and another more prominent firm for an exit. How much will you be walking away with? Leveraging the same table covered earlier, the below outlines steps to determine your company’s and the stakeholder’s exit return.

Call To Action:

Your Turn to Develop a Cap Table

In theory, a cap table is not a difficult task to maintain. However, after adding new employees and additional investors into the pool, keeping track of the table manually in a spreadsheet can become cumbersome. There are automated tools you can fall back on, such as cap share and carta, should the manual upkeep become too much of a pain.

Either tool you decide to use, the key is keeping the table up to date. As additional rounds of investments ensue, and your company dilutes further, it’s essential to keep track of all changes in your cap table.

This way, you know how much you own, the equity dilution, and the value of equity at any given moment. And in turn, investors are then able to understand what they are buying. Good luck!

Última actualización: 04/21/2022 por Sarahy Uribe